Exploring Cigarette Pricing: Factors, Trends, and Consumer Considerations

Cigarette pricing is a complex and multifaceted topic that impacts consumers, retailers, and public health initiatives alike. This comprehensive guide examines the various factors that influence cigarette costs, pricing trends across different regions, and important considerations for smokers navigating the market. Whether you’re a current smoker looking to understand pricing dynamics or simply interested in the economics of tobacco products, this article provides valuable insights into the world of cigarette pricing.

The tobacco industry is a major economic force, with cigarette sales generating billions in revenue annually. However, pricing strategies for these products are shaped by a variety of forces – from government regulations and taxes to manufacturing costs and brand positioning. By exploring these different elements, we can gain a clearer picture of how cigarette prices are determined and what consumers can expect when purchasing these products.

Throughout this article, we’ll examine topics such as the impact of taxes on cigarette costs, price variations between premium and discount brands, regional pricing differences, and strategies for finding the best deals on cigarettes. We’ll also touch on how pricing relates to public health goals and smoking cessation efforts. By the end, readers will have a comprehensive understanding of the cigarette pricing landscape and be better equipped to make informed purchasing decisions.

Factors Influencing Cigarette Prices

The cost of a pack of cigarettes is influenced by numerous interconnected factors. Understanding these elements provides insight into why prices can vary so significantly between brands, retailers, and locations.

Government Taxes and Regulations

One of the most significant drivers of cigarette pricing is government taxation. Federal, state, and sometimes local taxes are applied to tobacco products, often accounting for a large portion of the final retail price. These taxes serve dual purposes – generating revenue for governments while also acting as a deterrent to smoking by making cigarettes more expensive.

The level of taxation can vary dramatically between jurisdictions. Some states impose much higher cigarette taxes than others, leading to notable price differences across state lines. Additionally, tax rates may be periodically increased as part of public health initiatives aimed at reducing smoking rates.

Beyond taxes, other regulations can impact pricing. For example, minimum price laws in some areas set a floor on how low cigarette prices can go. Marketing restrictions may also influence how tobacco companies price and promote their products.

Manufacturing and Distribution Costs

The base cost of producing cigarettes factors into their retail price. This includes expenses related to tobacco cultivation, processing, manufacturing, packaging, and distribution. While large tobacco companies benefit from economies of scale, smaller producers may have higher per-unit costs that are reflected in pricing.

Global economic factors like fuel prices, labor costs, and currency exchange rates can all impact the manufacturing and distribution expenses for cigarette brands. Changes in these underlying costs may be passed on to consumers through price adjustments.

Brand Positioning and Marketing

Cigarette brands are often positioned at different price points as part of their overall marketing strategy. Premium brands command higher prices based on perceived quality, brand recognition, and targeted advertising. Budget or discount brands aim for more price-sensitive consumers with lower-cost options.

The amount spent on advertising and promotion can also factor into a brand’s pricing structure. Heavily marketed premium brands may charge more to offset these expenses, while discount brands may keep prices low by minimizing marketing costs.

Supply and Demand Dynamics

Like any consumer product, cigarette prices are influenced by supply and demand forces in the market. Factors like changing smoking rates, shifts in brand preferences, and product availability can all impact pricing. For example, if demand for a particular brand increases faster than supply, prices may rise accordingly.

Regional Variations in Cigarette Pricing

Cigarette prices can vary dramatically depending on geographic location, even within the same country. Understanding these regional differences is important for consumers and provides insight into broader economic and regulatory trends.

State-by-State Price Comparisons

In the United States, cigarette prices differ significantly between states due to variations in state tobacco taxes. As of 2023, states like New York, Connecticut, and Rhode Island have some of the highest cigarette taxes and correspondingly high retail prices. In contrast, states such as Missouri, Virginia, and North Dakota tend to have lower taxes and more affordable cigarette prices.

These price disparities can lead to cross-border purchasing, where smokers travel to neighboring states with lower prices to buy cigarettes. This practice is particularly common in areas where state borders intersect major population centers.

Urban vs. Rural Pricing

Even within states, cigarette prices often vary between urban and rural areas. Urban centers typically have higher overall costs of living, which can translate to elevated cigarette prices. Additionally, some cities impose their own tobacco taxes on top of state and federal taxes, further increasing prices for urban consumers.

Rural areas may offer more competitive pricing due to lower operating costs for retailers and potentially reduced local taxes. However, the trade-off can be less variety in available brands and fewer discount options.

International Price Comparisons

On a global scale, cigarette prices show even greater variation. Factors like local economic conditions, government policies, and cultural attitudes toward smoking all play a role in determining cigarette costs in different countries.

Some nations, particularly in Western Europe and Australia, have implemented very high tobacco taxes as part of comprehensive anti-smoking initiatives. This results in cigarette prices that may be several times higher than in countries with more lenient tobacco regulations.

Conversely, many developing nations have relatively low cigarette prices due to lower taxes, reduced manufacturing costs, and efforts by tobacco companies to expand market share in these regions. However, it’s important to note that even in countries with low nominal prices, cigarettes may still represent a significant expense relative to local incomes.

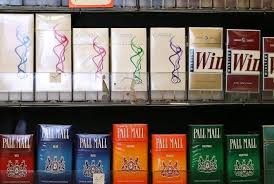

Premium vs. Discount Cigarette Brands

The cigarette market is segmented into different price tiers, with premium and discount brands catering to distinct consumer preferences and budgets. Understanding the differences between these categories can help smokers make more informed purchasing decisions.

Characteristics of Premium Cigarette Brands

Premium cigarette brands are positioned at the higher end of the price spectrum and typically emphasize quality, brand heritage, and a sophisticated image. These brands often feature:

- Higher-quality tobacco blends

- More elaborate packaging and design

- Extensive marketing and advertising campaigns

- Strong brand loyalty among consumers

- Wider availability across different types of retailers

Popular premium cigarette brands in many markets include Marlboro, Camel, and Newport. These brands generally command higher profit margins for manufacturers and retailers alike.

Features of Discount Cigarette Brands

Discount or budget cigarette brands aim to provide a more affordable smoking option. These brands are characterized by:

- Lower retail prices

- Simpler packaging and design

- Reduced marketing expenditures

- Appeal to price-sensitive consumers

- Often produced by smaller tobacco companies or as secondary brands by major manufacturers

Examples of discount cigarette brands might include labels like L&M, Pall Mall, or various store-brand options. While these products may use lower-cost ingredients or manufacturing processes, they must still meet regulatory standards for tobacco products.

Price-Quality Trade-offs

Consumers often debate whether the higher cost of premium brands is justified by a noticeable difference in quality or smoking experience. Some smokers report preferring the taste and consistency of premium brands, while others find discount options to be a satisfactory and more budget-friendly choice.

It’s worth noting that the actual production cost difference between premium and discount cigarettes is often less significant than their price gap would suggest. Much of the price premium for top brands is related to marketing, brand positioning, and higher profit margins rather than substantially higher manufacturing expenses.

Cigarette Pricing Strategies by Retailers

Retailers play a crucial role in determining the final price consumers pay for cigarettes. Various pricing strategies are employed to attract customers, manage inventory, and maximize profits within the constraints of regulations and competition.

Everyday Low Pricing vs. Promotional Discounts

Some retailers opt for an “everyday low price” strategy, offering consistently competitive prices on cigarettes to attract regular smokers. This approach can build customer loyalty and simplify inventory management.

Other stores rely more heavily on promotional discounts and sales. These might include:

- Temporary price reductions on specific brands

- Multi-pack discounts (e.g., “Buy 2, get 1 free”)

- Loyalty program rewards for cigarette purchases

Promotional strategies can drive short-term sales increases but may lead to more volatile pricing for consumers.

Bulk Purchase Options

Many retailers offer discounts for customers purchasing cigarettes in larger quantities, such as by the carton instead of individual packs. While the upfront cost is higher, the per-pack price is typically lower, appealing to heavier smokers or those looking to economize.

Carton sales can benefit retailers by increasing transaction values and potentially reducing the frequency of restocking. However, some jurisdictions have regulations limiting the number of cigarettes that can be purchased in a single transaction.

Price Matching and Competitive Positioning

In competitive markets, some retailers may offer price matching guarantees on cigarettes to prevent customers from shopping elsewhere. This can help stores retain price-sensitive smokers while maintaining their desired profit margins on other products.

Retailers must also consider their overall market positioning when setting cigarette prices. For example, a premium grocery store might maintain higher cigarette prices in line with their upscale image, while a discount chain might use aggressive cigarette pricing as a way to drive store traffic.

Online vs. In-Store Cigarette Pricing

The rise of e-commerce has impacted the cigarette market, although regulations around online tobacco sales are often stricter than for other products. Comparing online and brick-and-mortar pricing reveals interesting trends and considerations for consumers.

Regulatory Challenges for Online Cigarette Sales

Online cigarette sales face significant regulatory hurdles in many jurisdictions. Concerns about age verification, tax collection, and interstate commerce have led to restrictions or outright bans on internet cigarette purchases in some areas.

Where online sales are permitted, retailers must navigate complex compliance requirements, which can impact pricing and availability. These may include:

- Strict age verification processes

- Limits on shipping quantities

- Requirements to collect and remit taxes for the buyer’s location

- Bans on certain shipping methods (e.g., USPS generally cannot ship cigarettes)

Price Comparison Between Online and Physical Retailers

In markets where online cigarette sales are allowed, prices may sometimes be lower than in physical stores due to reduced overhead costs. However, shipping fees and tax compliance can offset these savings, especially for smaller orders.

Physical retailers often have the advantage of immediate availability and the ability to offer localized promotions. They may also benefit from impulse purchases and the convenience factor for customers.

Considerations for Online Cigarette Purchases

Consumers considering online cigarette purchases should weigh several factors:

- Legality in their jurisdiction

- Total cost including shipping and taxes

- Minimum order quantities

- Delivery timeframes

- Brand availability and authenticity concerns

- Privacy and age verification requirements

While online purchasing might offer savings in some cases, many smokers still prefer the immediacy and reliability of buying from local stores.

Impact of Taxes on Cigarette Pricing

Taxation is one of the most significant factors influencing cigarette prices and plays a central role in both public health policy and government revenue generation.

Federal Cigarette Taxes

In the United States, a federal excise tax is applied to all cigarettes sold. As of 2023, this tax stands at $1.01 per pack of 20 cigarettes. This rate is uniform across all states and brands, providing a baseline cost included in every pack sold in the country.

Federal cigarette taxes contribute to the general fund and help finance health care programs. Increases in the federal tax rate are relatively infrequent but can have a substantial impact on nationwide cigarette pricing when they occur.

State and Local Cigarette Taxes

State-level cigarette taxes vary widely and often have a more noticeable impact on retail prices than the federal tax. As of 2023, state cigarette taxes range from less than $0.50 per pack in some states to over $4.00 per pack in others.

Some localities (cities or counties) impose additional cigarette taxes on top of state and federal levies. These local taxes are particularly common in major urban areas and can significantly increase prices in specific municipalities.

The combination of federal, state, and local taxes means that in some high-tax jurisdictions, more than half of the retail price of a pack of cigarettes may be due to taxes.

Tax Stamps and Enforcement

To ensure proper tax collection, many states require tax stamps to be affixed to each pack of cigarettes sold. These stamps serve as proof that required taxes have been paid and help prevent the sale of untaxed or counterfeit cigarettes.

Enforcement efforts around cigarette taxation include:

- Audits of retailers and distributors

- Investigations into smuggling and black market sales

- Cooperation between states to address cross-border tax evasion

These measures aim to maintain the integrity of cigarette pricing and tax structures, though some degree of tax avoidance through various means remains an ongoing challenge.

Cigarette Pricing and Public Health Initiatives

Cigarette pricing is closely tied to public health efforts aimed at reducing smoking rates and mitigating the health impacts of tobacco use.

Price as a Deterrent to Smoking

Research consistently shows that higher cigarette prices lead to decreased smoking rates, particularly among young people and lower-income individuals who may be more price-sensitive. Public health advocates often push for tax increases as a way to discourage smoking initiation and promote cessation.

The World Health Organization recommends that tobacco taxes should account for at least 75% of the retail price of cigarettes as part of comprehensive tobacco control strategies.

Earmarking of Cigarette Tax Revenue

Many jurisdictions allocate a portion of cigarette tax revenue to fund smoking prevention and cessation programs. This creates a direct link between cigarette sales and efforts to reduce smoking rates and address tobacco-related health issues.

Examples of programs funded by cigarette taxes might include:

- Public education campaigns about the dangers of smoking

- Smoking cessation resources and support services

- Research into tobacco-related diseases and treatments

- General healthcare funding to offset smoking-related medical costs

Balancing Revenue and Public Health Goals

Policymakers often face a delicate balance when it comes to cigarette taxation. While higher taxes can reduce smoking rates and generate revenue, extremely high prices may lead to unintended consequences such as:

- Increased smuggling and black market activity

- Disproportionate financial burden on addicted smokers, particularly those with lower incomes

- Potential loss of tax revenue if consumption decreases dramatically

Finding the right balance between these competing interests remains an ongoing challenge in tobacco control policy.

Strategies for Finding the Best Cigarette Prices

For smokers looking to manage their expenses, there are several strategies to find more affordable cigarette options while staying within legal and ethical boundaries.

Utilizing Coupons and Promotions

Many cigarette brands offer coupons through various channels:

- Brand websites (with age verification)

- Direct mail promotions

- In-store displays and circulars

- Mobile apps and digital coupons

Taking advantage of these offers can lead to significant savings, especially when combined with retail sales or multi-pack discounts.

Loyalty Programs and Rewards

Some retailers and tobacco companies offer loyalty programs that provide rewards or discounts for frequent cigarette purchases. While these programs shouldn’t be a reason to smoke more, they can help regular smokers reduce costs.

Examples might include:

- Points-based systems redeemable for discounts

- Exclusive access to special promotions

- Cumulative purchase rewards

Comparing Prices Across Different Retailers

Cigarette prices can vary significantly between different types of retailers. Smokers may find better deals by comparing prices at:

- Gas stations and convenience stores

- Grocery stores and supermarkets

- Tobacco specialty shops

- Discount retailers and warehouse clubs

Online price comparison tools or apps can help identify the best local deals, though it’s important to factor in any membership fees or purchase minimums when evaluating total costs.

Considering Alternative Products

Some smokers find that switching to alternative tobacco or nicotine products can reduce their overall spending:

- Roll-your-own cigarettes using loose tobacco

- Pipe tobacco (which may be taxed at lower rates in some areas)

- Electronic cigarettes or vaping products

- Nicotine replacement therapies (for those looking to quit or reduce smoking)

While these alternatives may offer cost savings, it’s crucial to consider the health implications and ensure compliance with local regulations.

Future Trends in Cigarette Pricing

The cigarette market continues to evolve, with several factors likely to influence pricing trends in the coming years.

Potential for Further Tax Increases

Many health advocates and policymakers continue to push for higher cigarette taxes as a means of reducing smoking rates and generating revenue. Future tax hikes at federal, state, or local levels could lead to significant price increases for consumers.

Impact of Declining Smoking Rates

As overall smoking rates decline in many countries, tobacco companies may adjust their pricing strategies to maintain profitability. This could potentially lead to higher per-unit prices to offset reduced sales volumes.

Emergence of New Nicotine Products

The growing popularity of e-cigarettes, heated tobacco products, and other alternative nicotine delivery systems may impact traditional cigarette pricing. Competition from these products could put pressure on cigarette prices, or alternatively, lead to premium positioning of conventional cigarettes as a “classic” option. cigarettes price

Global Market Shifts

Changes in international tobacco markets, such as stricter regulations in developing countries or shifts in global leaf tobacco production, may influence cigarette pricing on a broader scale. Companies may need to adjust their pricing strategies to adapt to these evolving market conditions.

Conclusion

Cigarette pricing is a complex issue influenced by a myriad of factors including taxation, manufacturing costs, brand positioning, and public health initiatives. For consumers, understanding these dynamics can help in making informed purchasing decisions and managing smoking-related expenses.

While strategies exist for finding more affordable cigarette options, it’s important to remember that smoking comes with significant health risks regardless of the price paid. The most effective way to reduce smoking-related costs is ultimately to quit smoking altogether, and many resources are available to support those looking to do so. cigarettes price

As the tobacco landscape continues to evolve, cigarette pricing will likely remain a topic of ongoing debate and policy consideration. Balancing public health goals, government revenue needs, consumer behavior, and industry interests will continue to shape the future of cigarette pricing and availability. cigarettes price